As organizations and governments move towards a Digital Economy, questions from our service provider customers have been raised, willing to understand the impact of their investments on the data economy. The goal of this note is to explain the potential GDP impact for a country when a service provider invests $1 in Cloud Computing Infrastructure (servers, storage, networking, core cloud software) to build a national cloud.

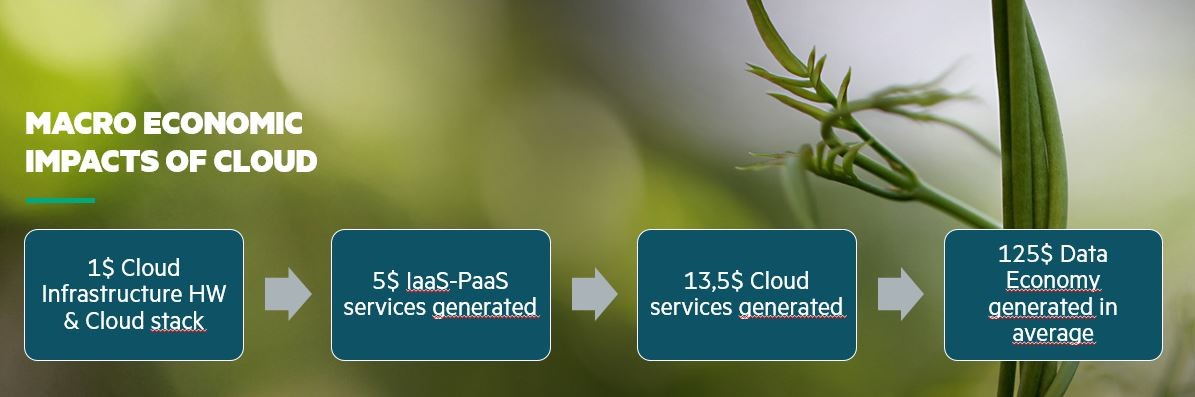

In my role I’m working with service providers around the world every day. From my experience and my review of various industry analyst reports, I have observed that when a service provider builds a national cloud, we can expect that $1 invested in Cloud computing infrastructure will generate an average $125 of data economy based GDP for the country while this yield will vary according to the nation digital readiness.

In the following pages, I will explain the components of cloud computing services and the analysis process followed. The pattern proposed is derived from industry analysts’ studies conducted in Europe (IDC) and what has been observed across the world through HPE certified service providers who represent the HPE virtual cloud.

Cloud computing is defined by accessing, in a self-service mode, a pool of resources (servers, storage, networking), elastic (scaling up, scaling down), orchestrated, and paid per use.

Three layers characterize a comprehensive cloud service: namely, infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). PaaS needs IaaS to execute, SaaS needs IaaS and generally PaaS to execute.

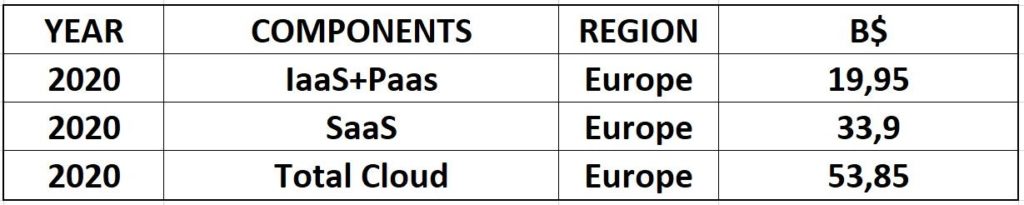

Looking at the European region, the Statista representation of the spending on these different layers in 2020, the split for IaaS, PaaS, SaaS services is:

How much cloud services revenue can be generated when investing $1 on cloud computing infrastructure?

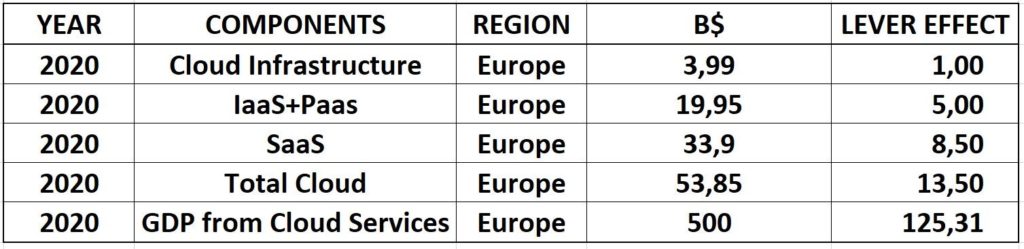

In 2020, the global infrastructure for the cloud market has been evaluated by industry analysts (IDC) at $68B and grew 8.8% in 2021. On a 3 year amortization schema, this means $22.7B cloud infrastructure usage worth in 2020.

During the same period, IDC pointed out that the IaaS + PaaS market worldwide had been worth $115B. Hence a 5X lever of the $22.7B cloud infrastructure usage worth. $1 spent on cloud infrastructure generates $5 of IaaS+PaaS revenue.

Our conclusion is that 1$ spent on cloud infrastructure will generate 13.5$ of cloud services across all categories IaaS, PaaS, SaaS, as per the table below.

IDC Analyst Firm reported in December 2021 that the Cloud Services contribution to GDP (Data Economy) in 2020 reached 500B$, – 2.7% of Europe GDP- which means that $1 spent that year in cloud infrastructure has generated a bit more than $125 of GDP in Europe in 2020. This is an average for Europe, some have generated less and some have generated more.

While the cloud infrastructure to IaaS+PaaS ratio (X5) can be considered as constant globally, the cloud infrastructure to SaaS ratio (X8.5 in the Europe Example, 2020) cannot be taken for granted in all countries as the revenue generated by SaaS depends on the Digital Economy maturity of the country; The more the country is mature, the higher is the level of SaaS revenues generated. Likewise, we see in this 2020 example that total cloud generated X9.3 GDP from cloud services, it may vary according to the country maturity on its digital transformation journey.

As a result, the X125 ratio GDP from cloud infrastructure (average in Europe, some countries may have a higher one, some others a lower one) cannot be confirmed for every country in the world, but it gives an interesting reference point. This ratio will depend on where the country stands in its digital transformation journey towards the creation of a digital economy. The more the journey is engaged, the better is the ratio. Our belief is that this ratio will vary in a range of X65 to X160 according the countries.

Service providers will benefit from these in the same way as governments will do. Indeed, most nations have the target to generate data economy-driven additional GDP for their country in order that data economy represents 2 – 4% of their GDP in the coming years at a minimum. Encouraging the development of a national cloud in their country will be the cornerstone of the data economy development.

- Among the criteria that will raise the ratio from 65 to the average of 125 we discussed, important points include:

- The level of country cloud first policy, including public sector IT

- The level of regulation for data sovereignty in order that data property stays where it has been created, in the country where it has been created.

- Government engagement with self-regulating private industry bodies to support and promote digital transformation, data regulation and data economy GDP creation

- The trust in cloud

- Vertical industry transformation towards data economy policy and incentives

- Security and trusted identity management

- Recognition of data as intangible assets

- Talent training and attractiveness

- Connectivity and datacenter availability

In conclusion, investment in IT infrastructure to foster the creation of national cloud service providers is one of the most efficient ways to increase country GDP over a short period of time. A $2690B nominal GDP country matching the average of Europe on its digital transformation journey could foresee a typical $25B increase of its GDP (circa 1% of its GDP) through data economy when national cloud service providers would invest $200M in cloud infrastructure. The return on investment could even be accelerated when these national cloud service providers would pay for the cloud infrastructure as they get paid for the services they offer to the market.

Lastly, the overall result could even be multiplied when these national cloud service providers would act as a federation of decentralized clouds within a group of countries sharing common economic and regulation rules, as it would for instance generate new intra trade flows and innovation through digital inside this group of countries.